Types Of Dividend Policy In Financial Management

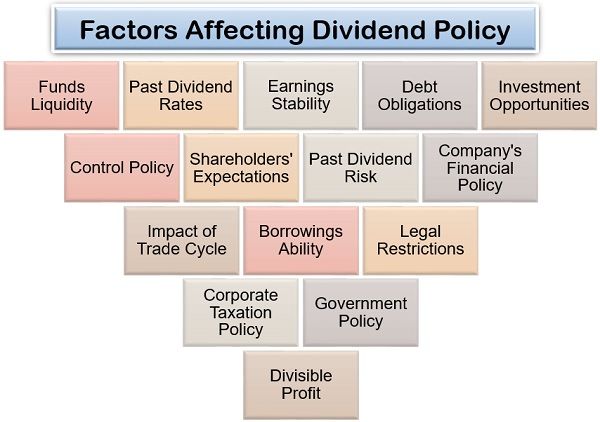

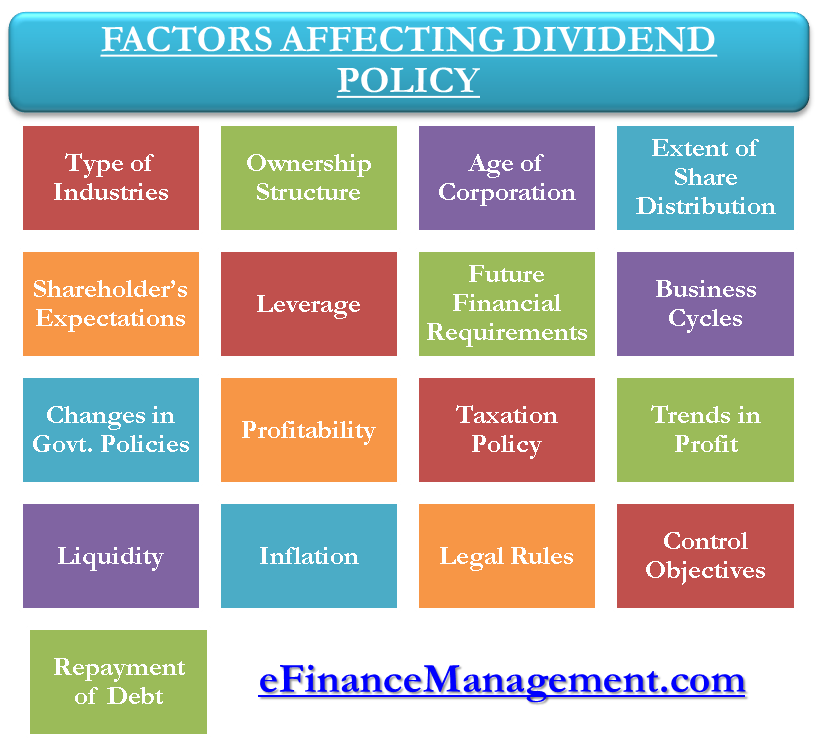

Several factors affect the payout policy of the company which includes various types of dividends model as well as repurchasing shares.

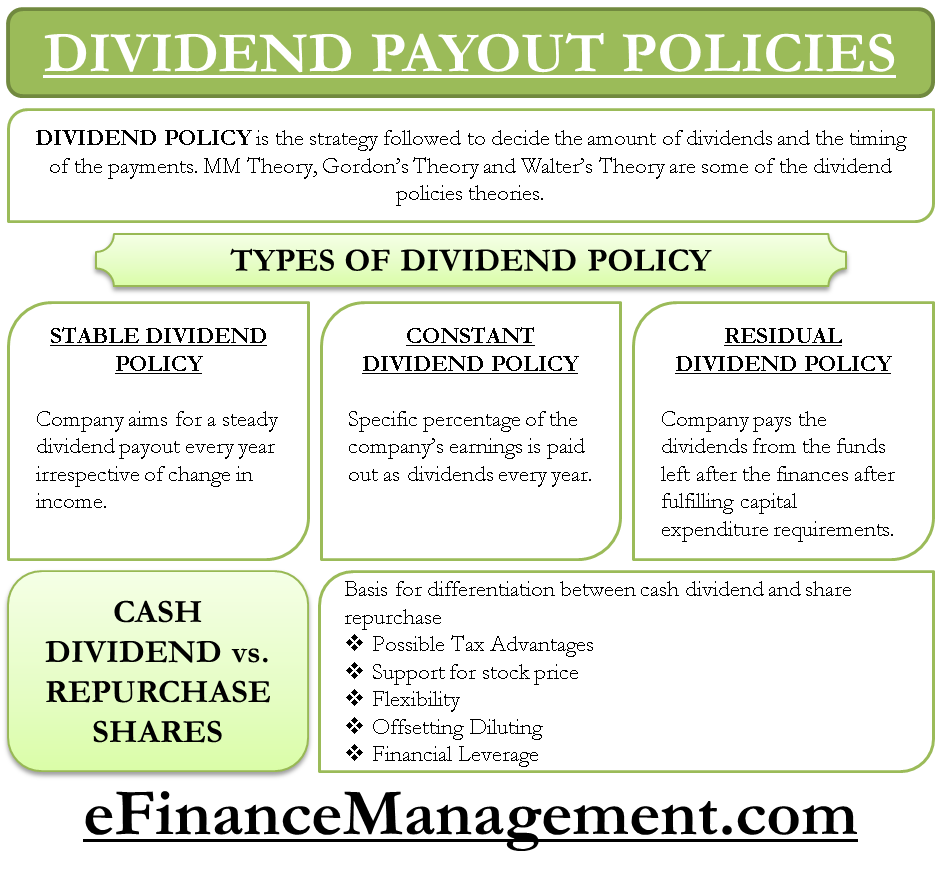

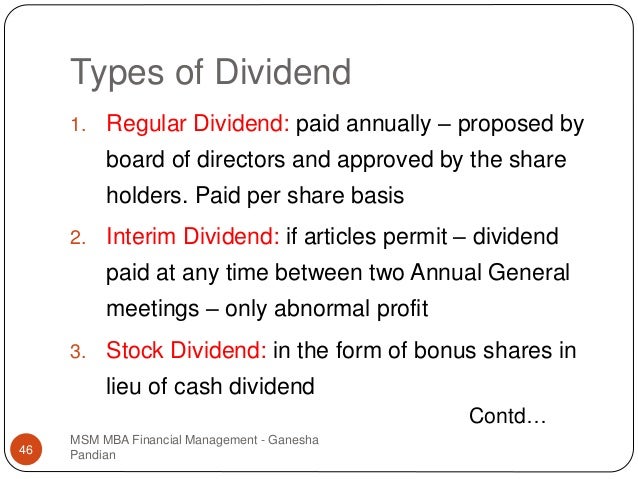

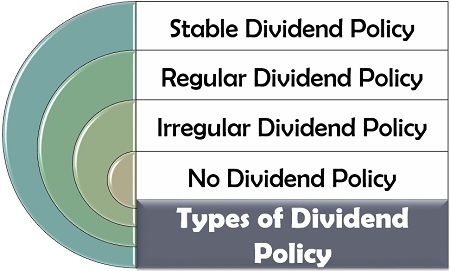

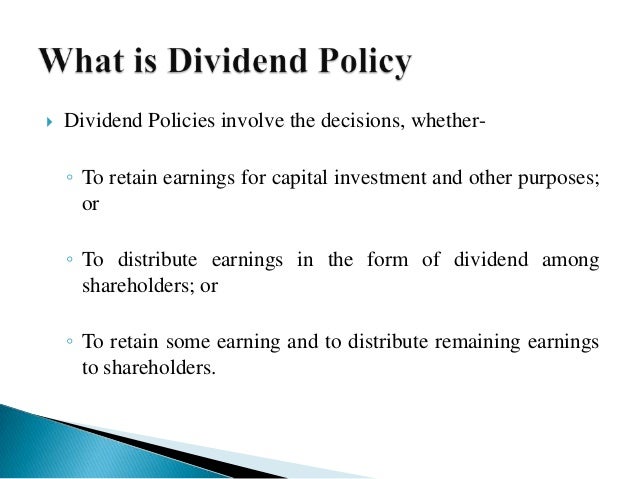

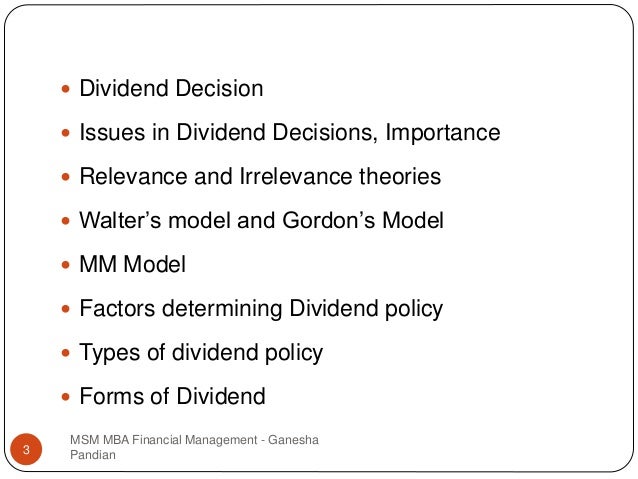

Types of dividend policy in financial management. Meaning of dividend policy. Dividend policy is one the essential components of financial management the profits earned by business organizations are either distributed to shareholders are retained by the business or in some cases it is partly retained and partly distributed. Four of the more commonly used dividend polices are described in the following diagram. Types of dividend policy.

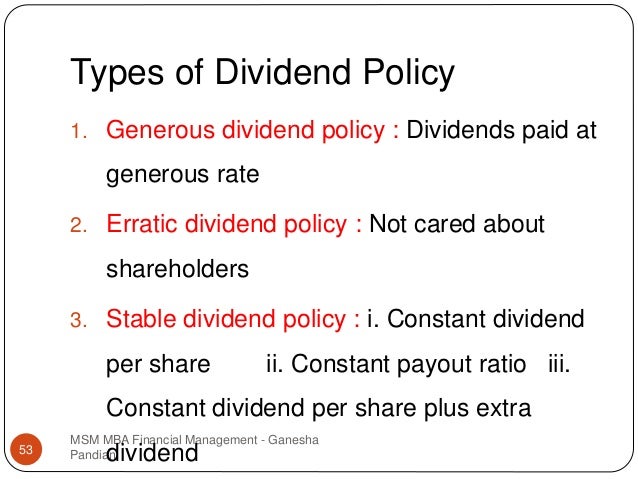

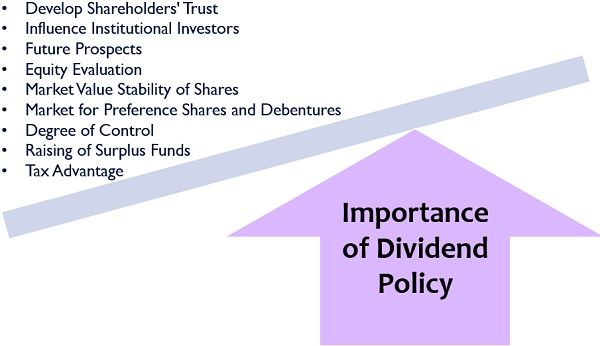

The clientele effect is the tendency of a firm to attract the type of investor who likes its dividend policy. They maintain that dividend policy has no effect on the market price of the shares and the value of the firm is determined by the earning capacity of the firm or its investment policy. The size and frequency of dividend payments are critical issues in company policy. Dividend policy affects the financial structure the flow of funds corporate liquidity stock prices and the morale of stockholders the finance manager plays an important role in the dividend policy.

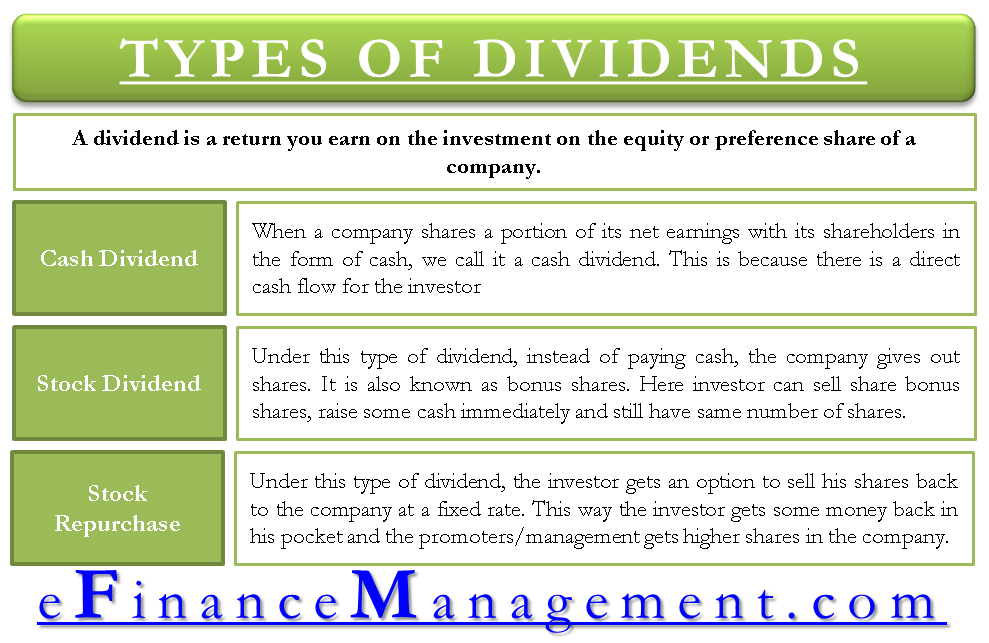

Here the investors are generally retired persons or weaker section of the society who want to get regular income. The dividends and dividend policy of a company are important factors that many investors consider when deciding what stocks to invest in. The splitting of earnings between retentions and dividends may be in any manner the firm likes does not affect the value of the firm. This type of dividend payment can be maintained only if the company has regular earning.

After reading this article you will learn about the meaning and types of dividend policy. Free cash flow hypothesis. The firm s dividend policy must be formulated with two basic objectives in mind. However they are under no obligation to repay shareholders using dividends.

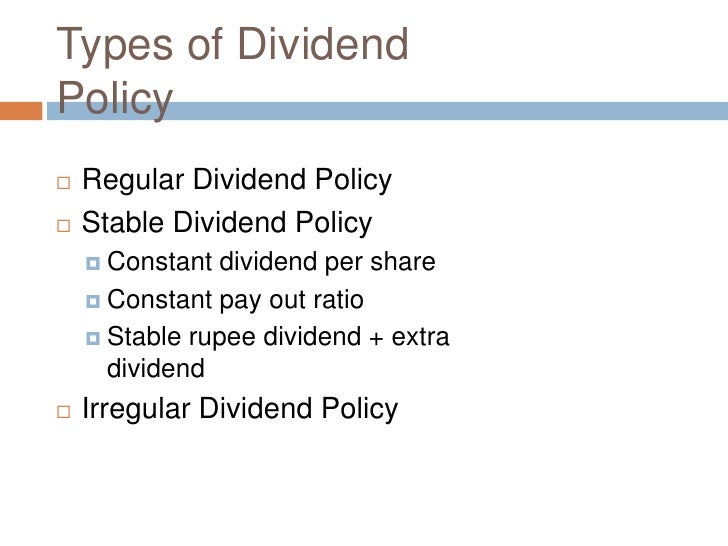

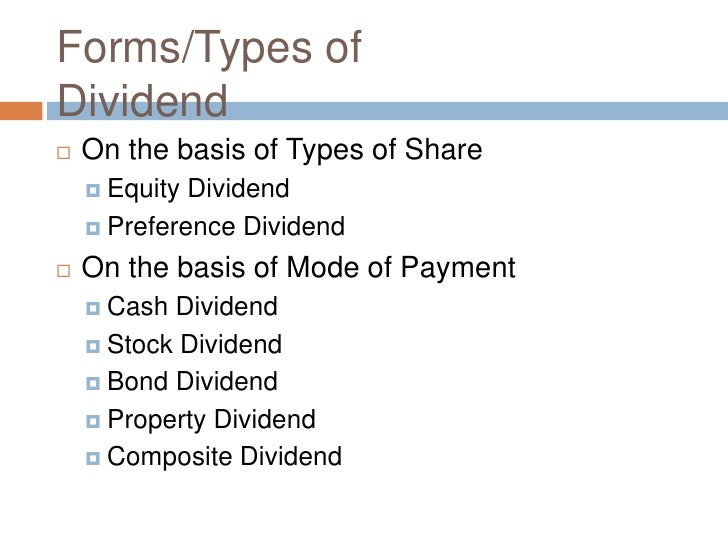

Types of dividend policies with advantages and disadvantages. In this type of dividend policy the investors get dividend at usual rate. Dividend policies are one of the important decisions taken by the company. Stable constant and residual are the three types of dividend policy.

Signaling hypothesis says that investors regard dividend changes as signals of management s earnings forecasts. The term dividend refers to that part of profits of a company which is distributed by the company among its shareholders. Dividend policy is crucial for every company. Dividends are often part of a company s strategy.

Dividend policies can be framed as per the requirements of the companies. The objective of dividend policy is to maximize shareholder s return so that the value of his investment is. 1 regular dividend policy.